Property Taxes

In Naperville, property taxes primarily fund the City’s long-term obligations, such as public safety and IMRF pensions and debt service payments. This tax is also the primary funding source for the Naperville Public Library and Naper Settlement operations.

The City’s diversified revenue base means a variety of revenue sources support Naperville’s city services, including sales, income, real estate transfer, and utility taxes, as well as charges for services. This model means the City is not entirely reliant on property taxes to support all of its service and capital needs.

The property tax rate and property tax levy are discussed as part of the City’s yearly budget process. The City’s budget follows a calendar year, with budget discussions occurring at the City Council level from October to November or December. The City’s Budget Team compiles the tax levy and tax rate based on the proposed operational and capital budget for the upcoming year, along with historical data and equalized assessed valuation (EAV) data from the five townships that include the City of Naperville.

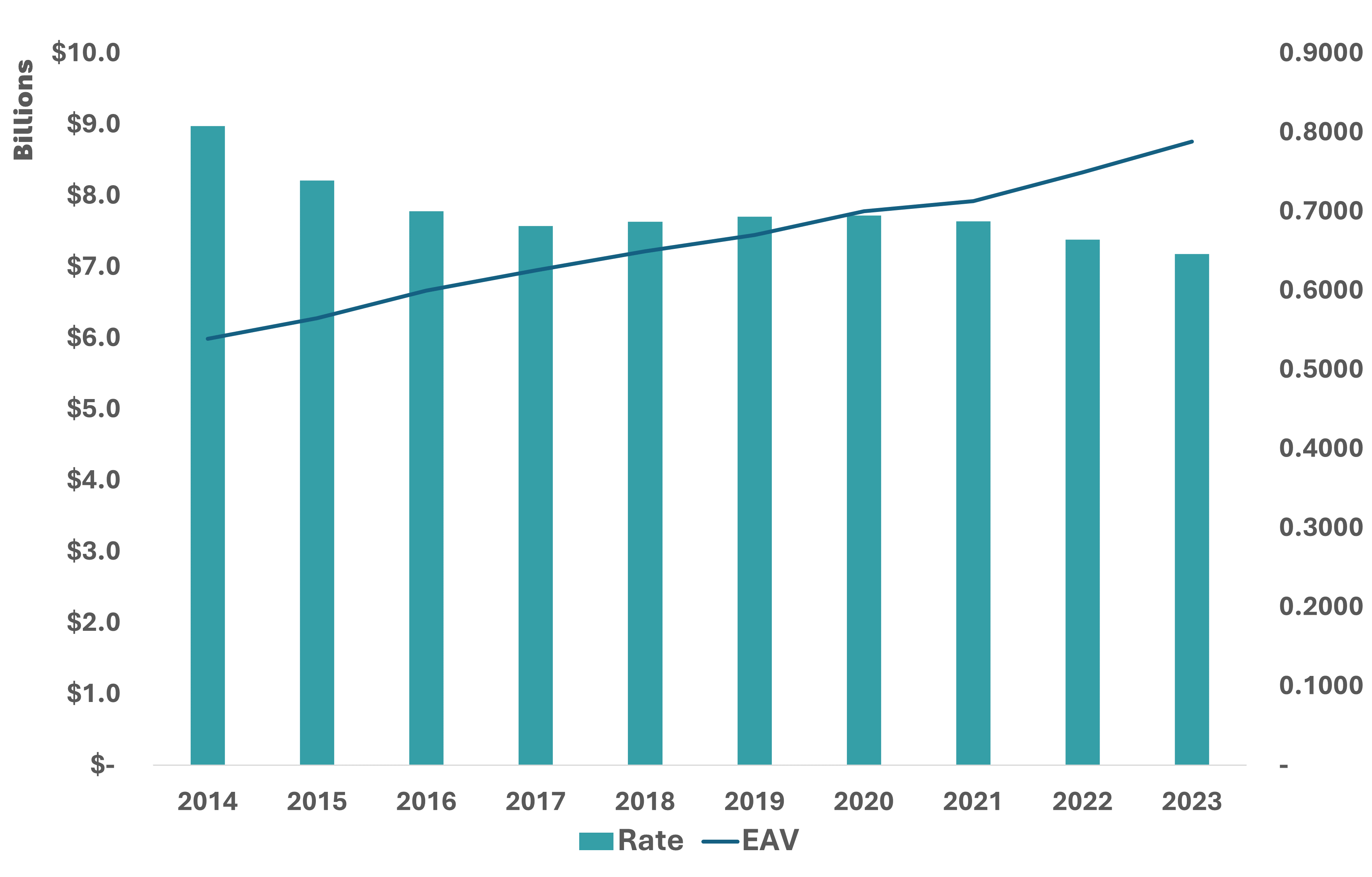

The City’s final 2023 property tax rate of 0.6463 is the lowest in more than 50 years. The levy and rate capture EAV growth due to new construction and appreciation. Using Naperville’s current median home value of $433,400 and assuming all other factors are equal, the owner of a home valued at that amount would pay $863 for the City portion of their property tax bill this year. A homeowner’s city property tax amount is ultimately based on their individual assessed property value.

Below is a graph showing the property tax rate each year since 2014 and the EAV for that same timeframe.